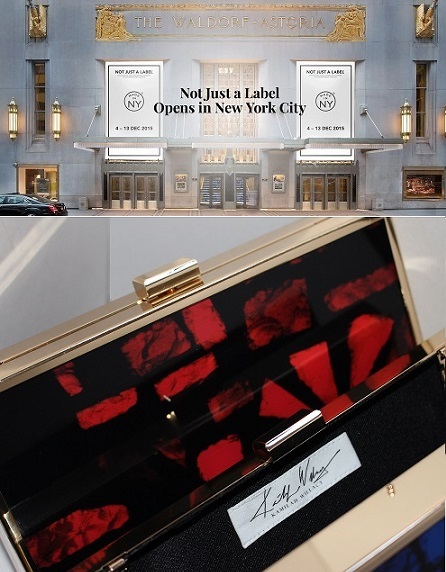

NEW YORK, NY, December 2, 2015 — /REAL TIME PRESS RELEASE/ — Part of the New York City Economic Development Corporation’s (NYCEDC) ‘Made in NY’ initiative, the NOT JUST A LABEL | Made in NY store will showcase a selection of NYC’s most notable emerging designers, including much talked about and highlighted Designer Kamilah Willacy.

Kamilah Willacy’s Design nominated Artworks collection will be shown which is not only made in New York but made in Kamilah Willacy’s very own Design Facilities which is rare for designers.

‘I decided to build out my own production facilities and produce my bags in house not because I wanted to, it was simply because no other factory in the world was used to working with the materials I use”, said Kamilah Willacy.

“I simply didn’t have a choice to produce on my own in New York; it was either design around the capability of the factories out there or produce myself and maintain my desired level of creativity” -Kamilah Willacy

Kamilah Willacy’s accessories are unique and set her apart from most accessories designer’s due to her architectural background and experience in the commercial development and furniture industry. Her industry knowledge as influenced her use of materials. Most of her work is made of architectural steel and high gloss poured glass resin and you will sometimes find real wood and marble used.

The company is Emerging and the go to bag for the royals and elite crowd due to her ability to create bespoke designs on demand.

“ I am able to create bespoke products for my elite customers because I have my own design facilities. It a rewarding feeling and sense of pride you have when you are able to offer something unique for your customers”, says Designer Kamilah Willacy.

Kamilah Willacy’s strategy launching her brand of accessories was to offer entry level pricing to allow the average consumer an opportunity to purchase her product. Starting Price points ranged from $225-$1100.

Her private bespoke bags which can sometimes incorporate real sterling silver frames plated with 24k gold featuring her original artwork can range from $2000-$15,500 on average.

Kamilah Willacy is an example of why the initiative for local fashion and manufacturing in New York is important. It is raising the level of creativity and stimulating the growth of jobs which is very mush needed.

NJAL’s mission is to highlight the city’s fashion industry to the cultural richness of the New York hospitality staple. NJAL is also hosting a series of conversations around all things Made in New York, with industry impresarios including Adam Selman, Gabi Asfour, Becca McCharan, Marcia Patmos, Shelley Fox, Burak Cakmak, and Kelly Cutrone.

For more information about this imitative see more at www.NOTJUSTALABEL.COM

For more information on Designer Kamilah Willacy see more at www.KamilahWillacy.com

Contact-Details: JOLE@ARCDEGLOBAL.COM

###